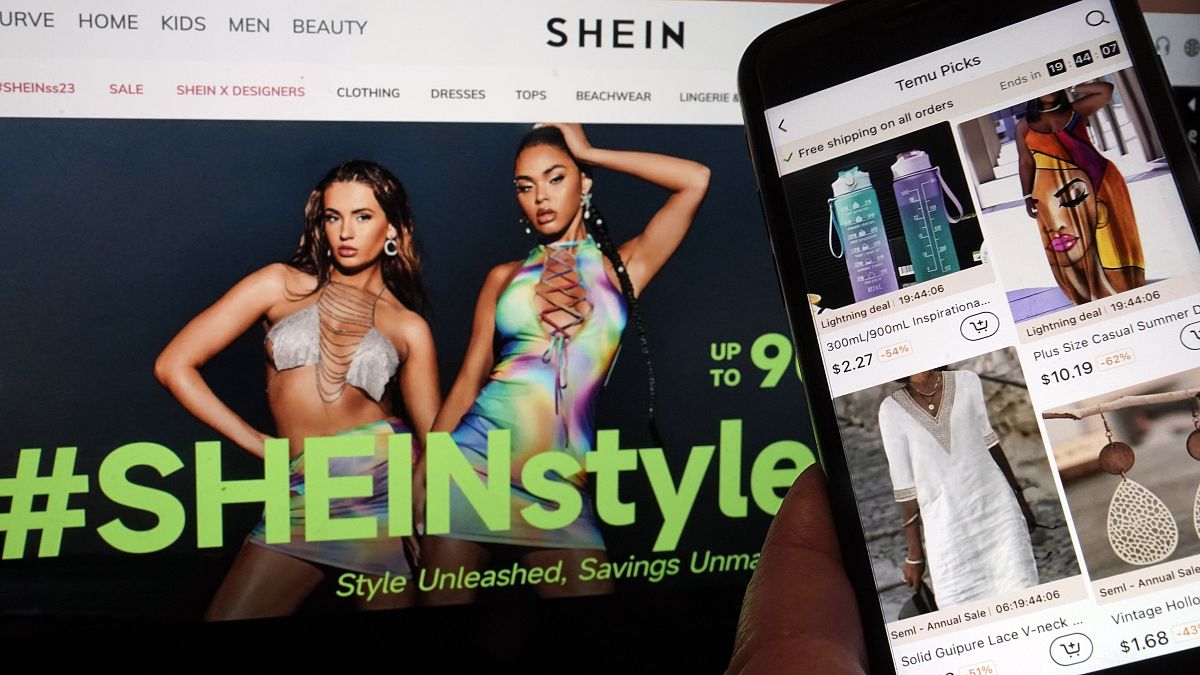

Shein and other fast fashion companies could be heavily impacted by new tax changes in the US, which could close a key loophole vital for their business models.

Chinese fast fashion retailer Shein could find it more difficult to achieve its planned London listing, worth approximately £50 billion (€60.10), following US president Donald Trump’s plan to make a key tax change.

This move will involve potentially getting rid of a tax loophole that Shein has been significantly relying on, which is the de minimis exemption, a trade law that has been in place since 1930. The exemption applies to small packages, which are worth less than $800 (€771.6) and are shipped into the US from Canada, China and Mexico.

Under this law, these packages can sidestep import taxes, as long as they are sent directly to home addresses or individual buyers in the US.

Shein and rival Chinese fast fashion company Temu both rely on this exemption, since currently, the majority of their US packages fall under this limit and are thus custom duty exempt. This has allowed them to be able to sell their goods at much lower prices in the US than domestic competitors.

With this law now possibly being revoked, Shein may be forced to push back its London initial public offering (IPO) in an attempt to deal with these changes and amend its business model accordingly, if needed.

The uncertainty around these tax changes and their potential impact on sales is expected to make it more difficult for Shein to reassure investors about its financial stability, outlook and business model, further complicating the company’s listing prospects.

It has also led to increased worries about the UK and EU implementing similar measures.

If custom duties increase, Shein and other impacted companies could pass on these costs to US consumers, which could erode their market share. This is especially because very low prices, rather than quality or ethical standards, are the main attraction of these retailers in the US market.

Michael Sobolik, senior fellow at the Hudson Institute, said as reported by The Telegraph: “If they behave like most companies do, I wouldn’t be surprised if they try to pass it [costs] on.

“But they find themselves facing a different challenge, which is the value proposition for the US consumer and how insanely cheap these products are.

“American consumers are going to have to ask themselves, are they going to be willing to pay higher prices for these goods?”

Apart from these tax woes, Shein could still have to jump through several hoops to complete its London listing.

Adam Zoucha, senior vice president at FloQast, said in an email note: “The success of Shein’s IPO will lie in the strength of its initial preparation and ability to adapt to the demands of shareholders and regulators as a public company. Holding up to the scrutiny of capital markets requires a combination of attributes, namely transparency and integrity.

“Fiscal planning, strong leadership and a commitment to governance and compliance is essential. Having a tightly controlled balance sheet is half the battle. Then it’s a matter of ensuring internal controls are watertight with checks and balances baked in.”

Euronews has contacted Shein for comment.

US tax loophole heavily criticised for overuse

The de minimis exemption has faced rising backlash in the last few years, with increasing allegations of it being abused and overused. This is especially because of its impact on domestic companies, which are often severely undercut by companies like Temu and Shein.

The loophole has also been slammed for aggravating the US’s drug problem through packages carrying illegal substances. This is mainly because small packages are often not as thoroughly checked as larger ones. The sheer volume of small packages in the last few years, boosted by the surge in online shopping, has also exacerbated this issue.

The US Customs and Border Protection said on its website: “Contrary to popular belief, good things do not always come in small packages. In fiscal year 2023, 85% of the shipments U.S. Customs and Border Protection seized for health and safety violations were small packages.

“Bad actors are exploiting this explosion in volume to traffic counterfeits, dangerous narcotics, and other illicit goods including precursor chemicals and materials such as pill presses and die molds used to manufacture fentanyl and other synthetic drugs that are killing Americans.”

Andrew Renna, assistant port director for Cargo Operations at New York City’s JFK Airport, also said: “On any given day, we could receive and process 750,000 to a million de minimis shipments. We have limited resources. We only have X number of staff. There is no physical way if I doubled or even tripled my staffing that I could look at a significant percentage of that. So due to the volume, it’s a very exploitable mode of entry into the US.”