It is an unlucky time for the humble penny, the smallest unit of the US dollar, as President Donald Trump’s decision to “cancel” the minting of the coin earlier this year finally came into force this week.

The Treasurer of the United States, Brandon Beach, stamped the last penny after 230 years of its production by the US Mint on Wednesday, at an event held at the minting facility in Philadelphia.

The final pennies bear a special Omega stamp and will not be put into circulation, and will instead be auctioned off.

According to the president, pennies now cost far more to make than they are worth.

Merchants in multiple regions of the country have run out of pennies and are unable to produce exact change. Meanwhile, banks cannot order fresh pennies and are rationing what they have for customers.

One convenience store chain, Sheetz, became so desperate for pennies that it briefly ran a promotion offering a free soda to customers who brought in 100 pennies.

Another retailer said the lack of pennies will end up costing it millions this year because of the need to round down to avoid lawsuits.

The penny problem began in late summer and is only getting worse as the country heads into the holiday shopping season. To be sure, not one retailer or bank has called for the penny to stick around.

A new era for pocket change

Pennies, especially in bulk, are heavy and are more often than not used exclusively to give customers change.

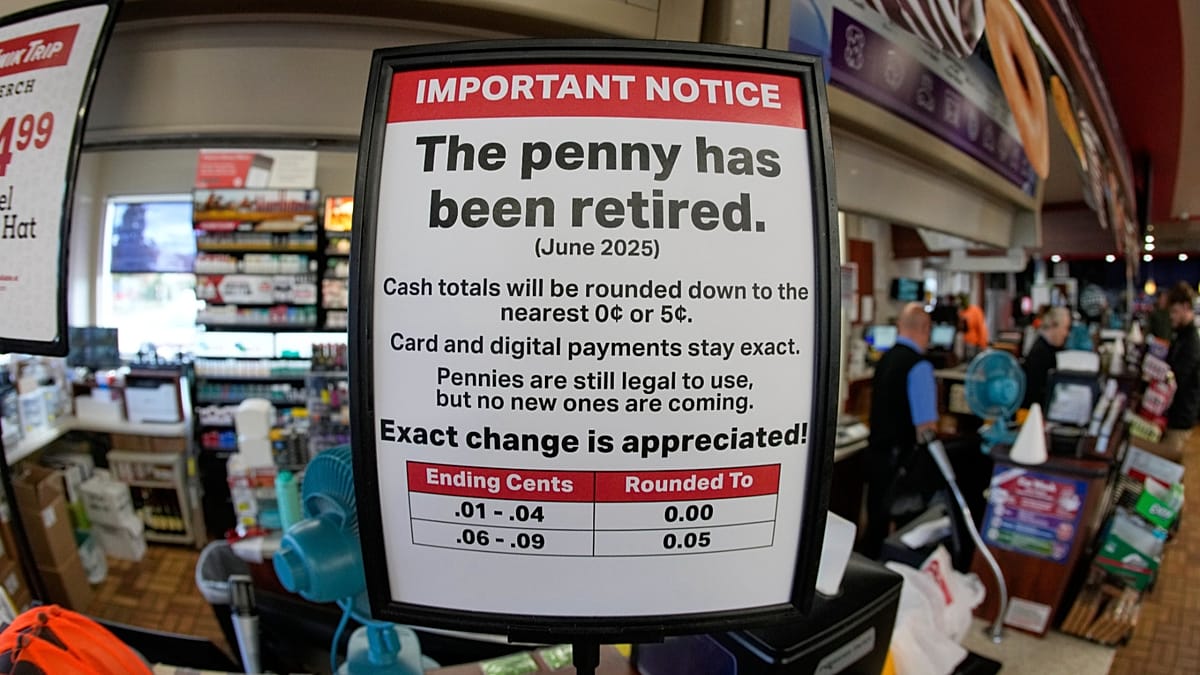

But the abrupt decision to get rid of the coin has come with no accompanying guidance from the federal government. Many stores have been left pleading for Americans to pay in exact change.

“We have been advocating abolition of the penny for 30 years. But this is not the way we wanted it to go,” said Jeff Lenard of the National Association of Convenience Stores.

Trump announced on 9 February that the US would no longer mint pennies. Both the penny and the nickel have cost more to produce than they are worth for several years, despite efforts by the US Mint to reduce costs.

The Mint spent 3.7 cents to make a penny in 2024, according to its most recent annual report, and it spends 13.8 cents to make a nickel.

“Let’s rip the waste out of our great nation’s budget, even if it’s a penny at a time,” Trump wrote on Truth Social.

The Treasury Department said in May that it was placing its last order of copper-zinc planchets — the blank metal disks that are minted into coins.

Troy Richards, president of Louisiana-based Guaranty Bank & Trust Co., said he had to scramble to have enough pennies on hand for his customers since August.

“We got an email announcement from the Federal Reserve that penny shipments would be curtailed. Little did we know that those shipments were already over for us,” Richards said.

He added that the $1,800 (€1,546) in pennies the bank had were gone in two weeks. His branches are keeping small amounts of pennies for customers who need to cash checks.

No more penny hoarding

The US Mint issued 3.23 billion pennies in 2024, the last full year of production — more than double the output of the country’s second-most minted coin, the quarter.

But pennies are rarely recirculated back into the economy after they being issued and given as change.

Americans tend to store them in jars or use them for decoration, requiring the Mint to produce significant volumes each year to compensate.

The government is expected to save $56 million (€48,11mn) by halting penny minting, according to the Treasury Department.

Despite the losses on pennies, the Mint remains profitable for the US government through its production of other circulating coins as well as coin proofs and commemorative sets that appeal to numismatic collectors.

Alongside Americans’ hoarding habits, a logistical issue is also preventing pennies from circulating.

Coin distribution is handled by the Federal Reserve system. Several companies, mostly armored carrier companies, operate coin terminals where banks can withdraw and deposit coins.

Roughly a third of these 170 coin terminals are now closed to both penny deposits and penny withdrawals.

Bank lobbyists say the closures are worsening the shortage because parts of the country that may still have spare pennies cannot send them to regions that are running out.

“As a result of the US Department of the Treasury’s decision to end production of the penny, coin distribution locations accepting penny deposits and fulfilling orders will vary over time as (penny) inventory is depleted,” a Federal Reserve spokeswoman said.

Vendors run short on change

The lack of pennies has also become a legal minefield for stores and retailers.

In some states and cities, rounding up a transaction to the nearest nickel or dime is illegal because it would violate rules requiring equal treatment of cash, debit and credit customers.

To avoid lawsuits, retailers are rounding down. While two or three cents may seem minor, the lost revenue adds up over tens of thousands of transactions.

A spokesman for Kwik Trip, the Midwest convenience store chain, says it has been rounding down every cash transaction to the nearest nickel — a change that could cost roughly $3 million (€2,57m) this year.

Some retailers are asking customers to donate their change to local charities in an effort to avoid pennies altogether.

A bill currently pending in Congress, known as the Common Cents Act, calls for cash transactions to be rounded to the nearest nickel, up or down. While widely supported by businesses, rounding up could be costly for consumers.

The Treasury Department did not respond to a request for comment on whether it had any guidance for retailers or banks regarding the penny shortage, or the issues around circulation.

Americans aren’t the only penny-pinchers

The United States is not the first country to phase out small-denomination coins.

But in most cases, governments wound down use of their coins over years, not months.

Canada announced the elimination of its one-cent coin in 2012, transitioning away from one-cent cash transactions starting in 2013. The country is still redeeming and recycling one-cent coins a decade later.

The UK’s “decimalisation” — converting farthings and shillings to a 100-pence system — took much of the 1960s and early 1970s.

By contrast, the US removed the penny from commerce abruptly, without any action by Congress or regulatory guidance for banks, retailers or states.

“We don’t want the penny back. We just want some sort of clarity from the federal government on what to do, as this issue is only going to get worse,” said NACS’ Lenard.

A brief history of the US penny

The penny was one of the first coins made by the US Mint after its establishment in 1792, when only the half-cent and one-cent coins were in production.

Congress eventually discontinued the unpopular half cent in 1857 but kept the penny, making it smaller to save money on the copper needed to make the coin.

Today, the penny is made with 97.5% zinc with copper plating.

There are an estimated 250 billion pennies still in circulation in the US, according to the American Bankers Association. This means the last pressed pennies will not disappear quickly, but circulation will slow.

Pennies remain legal tender, and will continue to be worth the same humble one cent.

Defenders of the coin say the cost to make pennies is modest compared to other denominations. A nickel costs almost 14 cents to mint; each dime costs nearly 6 cents; and a quarter costs nearly 15 cents.