The euro declined against the US dollar to its lowest level since November 2022. The dollar soared after the Federal Reserve delivered its third rate cut of the year and projected a slow easy cycle in 2025.

The euro tumbled against the US dollar to near a two-year low of mid-1.03, a level briefly reached late in November and the lowest in two years. The decline was triggered by the Federal Reserve’s (Fed) hawkish rate cut on Wednesday night. The EUR/USD pair dropped more than 1%, or 1.4 US cents per euro before a slight rebound in the Asian session on Thursday.

Fed delivered a hawkish rate cut

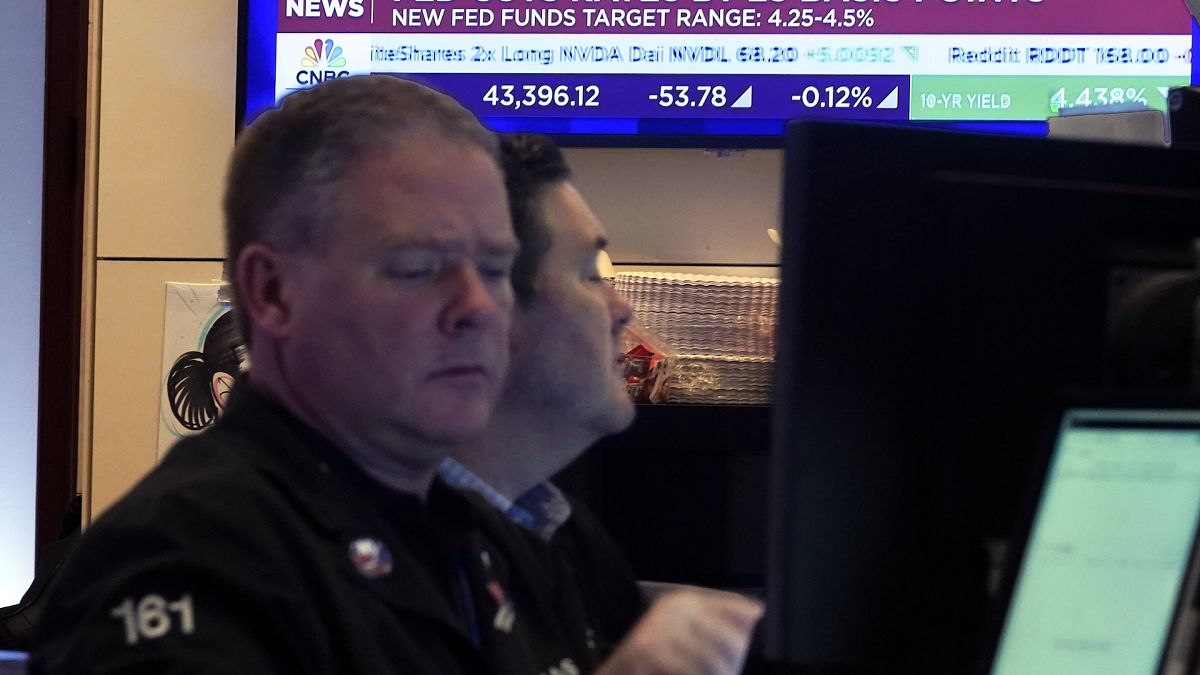

The Fed cut the interest rate by 25 basis points as expected. However, the bank signalled a much more hawkish stance on its easing cycle next year. The Fed’s dot plot, a chart that projects the future path of interest rates, indicated a half-percentage point rate cut in 2025, compared with a full percentage cut projected in September.

The unexpected shift in the Fed’s policy stance sent jitters through global markets, with the US dollar soaring, alongside surging US government bond yields. The US dollar index jumped above 108, a pivotal technical resistance, reaching the highest since November 2022. The US 10-year government bond yield rose 11 basis points to a six-and-a-half-month high of 4.51%.

The ECB may stay relatively dovish

In contrast, the European Central Bank (ECB) is expected to further reduce the interest rate by at least a full percentage point next year, which is a much more dovish easing policy than that of the Fed. Analysts anticipated that the ECB may have to accelerate rate cuts in 2025 amid the ongoing challenges facing the eurozone. Political instability, China’s slowdown, and a Trump presidency, all contribute to a gloomy economic outlook of the region.

Last week, the bank lowered the rate by 25 basis points for the fourth time this year. While reiterating a restrictive policy, ECB president Christine indicated interest rates will lower further if incoming data aligns with expectations. She also noted that Trump’s protectionist measures are likely to impact the eurozone’s economic growth.

Adding to the negatives, the flash manufacturing PMI indicated a deepening recession in the sector for both Germany and France, accroding to the S&P Global’s estimates. France’s central bank lowered its forecast for the country’s economic growth to 0.9% in 2025 from previously projected 1.2%, following Moody’s downgrade on French credit rating.

Risk-off prevails in global markets

The Fed’s hawkish shift has significantly sparked risk-off sentiment across the global markets, with the fear gauge the CBOE volatility index (VIX) soaring 74% to above 27, the highest since August when global stock markets experienced panic selloffs due to Bank of Japan’s rate hike.

In currencies, not only was the euro hit hard by the Fed’s hawkish shift, but other non-US currencies also experienced sharp declines against the dollar. Particularly, commodity currencies, including the Canadian dollar, the Australian dollar, and the New Zealand dollar, all suffered from a strong USD, weakening sharply to their multi-year low levels. The Canadian dollar fell to its lowest since March 2020 when the Pandemic started. Previously, Trump vowed to impose a 25% tariff on imports of Canadian goods.

Wall Street tumbled, with three major benchmarks, including the Dow Jones Industrial, the S&P 500, and the Nasdaq, all falling between 2% and 3% on Wednesday. The Dow slumped more than 1,000 points, extending a nine-day losing streak. Mirroring the movement, the European stock markets are likely to take a hit by the widespread risk-off sentiment.

In commodities, metal, and crude oil prices all experienced declines. However, gold prices saw a swift rebound in the Asian session on Thursday, most likely due to the risk-off sentiment.

Cryptocurrencies fell on a broad-based selloff, with Bitcoin prices falling to below the $100,000 mark at a point after briefly topping $108,000 on Tuesday.