Swiss drug firm Novartis reported on Tuesday that it had generated a better-than-expected profit in the first three months of the year.

Net sales were up 15% on a constant currency basis to $13.2 billion, compared to the $13.12bn estimated by analysts.

Core operating income came to $5.6bn, up 23% in the last quarter, while core net income increased 22% to $4.5bn.

On the strong results, the firm increased its outlook for the year, predicting that sales will rise by high-single digits and core operating income will grow by low double-digits. In January, the firm gave a wider range.

Sales in the last quarter were driven by medicines related to conditions including arthritis, breast cancer, multiple sclerosis, and heart-failure.

Over the quarter, the company’s breast cancer drug Kisqali saw revenues rise by 56% to $956 million.

Heart-failure drug Entresto saw a 22% jump to around $2.3bn, while arthritis medicine Cosentyx saw revenues rise 18% to around $1.5bn.

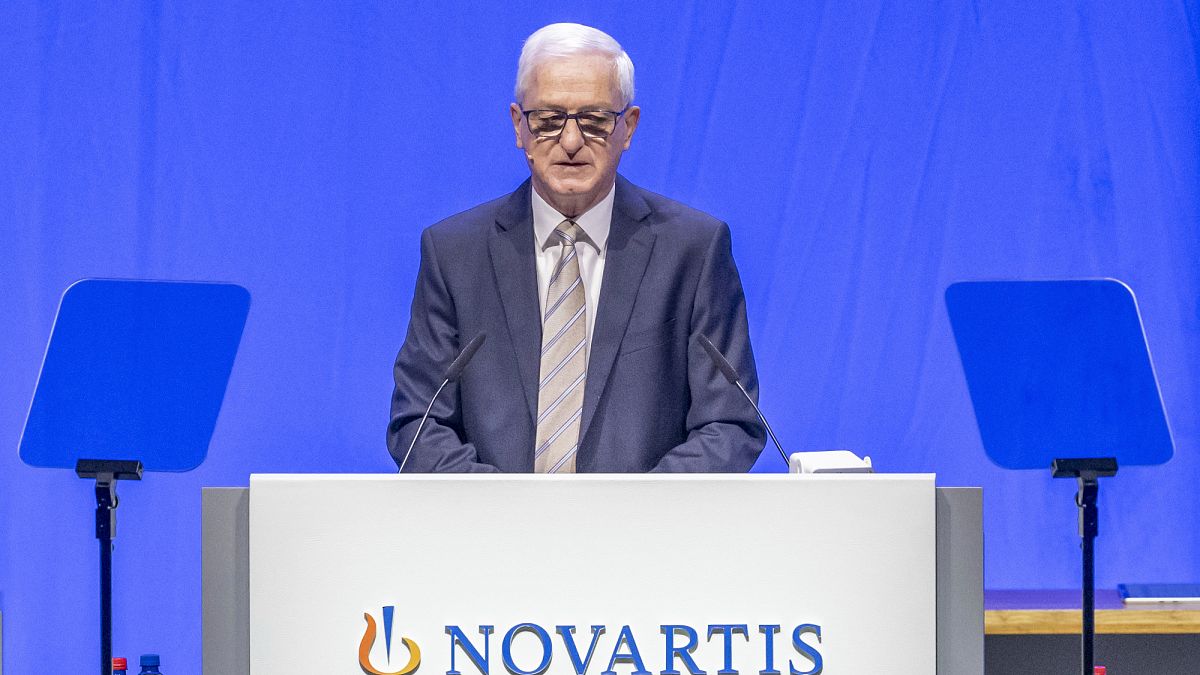

Vas Narasimhan, CEO of Novartis, also highlighted new approvals in the earnings report.

“We also achieved significant innovation milestones in the quarter, with new approvals for Pluvicto in the pre-taxane setting, Vanrafia for IgA nephropathy, and Fabhalta for C3G,” Narasimhan said.

He added: “We remain focused on advancing our leading pipeline and confident in achieving our growth outlook.”

Novartis is closely watching decisions from the White House to determine how pharmaceutical products coming into the US will be taxed.

The Trump administration opened a 21-day national security probe into the industry earlier this month. Pharmaceuticals are currently exempt from a so-called “reciprocal” tariff rate, although Trump has suggested imposing a 25% levy on medicines.

Novartis announced a few weeks ago that it would invest $23bn in the US over the next five years to build and expand 10 facilities. The firm aims to domestically produce all medicines for US patients.